Masterworks io is an alternative investment platform that sells fractional interests in art. With no minimum investment requirement and affordable prices, Masterworks makes it relatively easy for investors to purchase contemporary art from renowned artists such as Banksy and Jean-Michel Basquiat. The platform offers good research and support resources and a well-designed, easy-to-use interface. If you’re looking to diversify your portfolio by investing in the art without spending a fortune, Masterworks offers an attractive option.

Pro

- The platform provides good investment research on the fine art and contemporary art market

- Masterworks manages the entire process of finding, buying, and storing art

- No minimum investment

- The platform is well designed and easy to use

- Provide early liquidity through the secondary market

Cons

- Fine art is a relatively high-risk investment with no recurring source of income

- It could take three to ten years for the company to sell artwork and generate returns for investors.

- Relatively high fees compared to other types of managed investments

- Liquidity is limited and users can only sell shares in advance if they find willing buyers in the secondary market

- Must have a short interview with the company to join

- no mobile app

Skip Waitlist

Who should choose a masterwork io?

Masterpieces can be a great option for someone who wants to add an alternative fine art investment to their portfolio but prefers to avoid the cost, risk, and hassle of buying fine art.

Regular investors with limited budgets can access Masterworks as there are no minimum investment requirements to open an account and buy fractional shares of contemporary art.

However, investing in art involves unusual risks. It may take Masterworks years to sell a piece of art from its portfolio, and there is no guarantee that the piece will be profitable. According to Masterworks, the contemporary art market has returned an average annual rate of 14.1% over the past 26 years.

This makes Masterworks the best choice for clients willing to take extra risks for a higher chance of winning. Also, ideally, potential investors should have a passion for contemporary art and basic knowledge of the art world, as you need to decide which artworks to invest in.

For investors looking to generate consistent income or looking for more straightforward, safer alternative investments, Masterworks may not be suitable. It’s also not ideal for investors who need cash. While it is possible to cash out your fractional stake in the artwork early in the secondary masterpiece market, it is not guaranteed.

To be safe, it’s best to only invest in Masterworks funds that you can afford to lock up for years until the platform finally sells the artwork you’ve invested in.

How the Masterworks io Platform Works

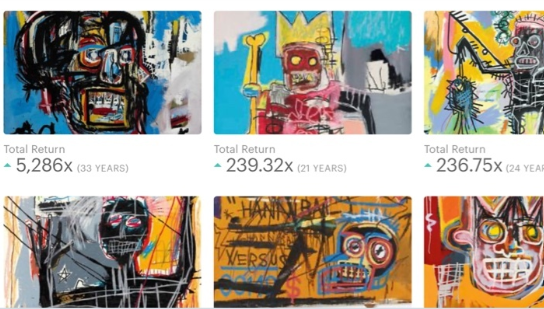

Masterworks uses crowdfunding to purchase contemporary art. The firm’s research team evaluates promising contemporary artists and purchases artworks they believe are likely to appreciate in value over time.

After purchasing contemporary art, Masterworks files with the U.S. Securities and Exchange Commission (SEC) to sell a partial stake in the art to investors through its platform. The registration of each artwork with the SEC makes it an accredited investment, allowing Masterworks to accept both retail and accredited investors.

Masterworks sells 90 days of stock to its members as a primary offering after the SEC approves individual artwork filings. There is no minimum investment and you can decide how many shares to buy at the price shown. The company tends to price fractional shares at $20.

Masterworks hold artworks for three to ten years until they find a good opportunity to sell them to collectors in the contemporary art market. After the sale of the artwork is complete, Masterworks distributes all profits to investors who own shares in the artwork, by the number of shares held minus its own share of the profits (see below for details).

The platform offers a secondary market if you want to cash out your fractional stake before Masterworks sells your art. Users can buy and sell stock to other Masterworks users, but there is no guarantee that there will be a buyer if you want to sell your stock. Secondary market prices are entirely dependent on the needs of other Masterworks customers.

Please note that the Masterworks secondary market is only open to US citizens who have a bank account with a US bank.

Masterworks io Fees and Costs

Masterworks charges two fees. First, they charge an annual management fee of 1.5% based on your total account value. They deduct this fee from your share capital every year, gradually reducing the number of shares you own. You cannot choose to pay the fee in cash.

Second, if Masterworks sells artwork on the open market for a profit after three to ten years, they keep 20% of the profit. Masterworks uses these fees to offset the additional costs of managing the artwork, such as storage, appraisals, and insurance, as well as SEC regulatory fees.

Masterworks does not charge any transaction fees. There is no fee for you to buy the stock for the first time or sell it to another investor in the secondary market.

Skip Waitlist

Masterworks io Advantage

Excellent art investment research

Masterworks offers users a great resource for researching the comparative art and fine art markets. On top of that, they offer a contemporary art price database to track thousands of artworks. You can search for specific artists and find prices for their work.

The database provides financial information about each work, such as recent sales, total appreciation, and annual return on investment. Masterworks also has articles and videos that educate people about investing in art.

Well-designed platform

The Masterworks platform is clean, simple, and well-designed. It’s easy to find the information you need about different artworks and investing.

High yield potential return

Historically, art has generated higher returns than other investments such as stocks, bonds and real estate. Over the past 26 years, the average annual return on investment in art has been 14.1%. During the same period, the S&P 500 posted an annual gain of 9.9%.

Illustrations can provide additional diversification to your portfolio. The rise and fall of the art market is relatively uncorrelated to the stock market and can provide a hedge against lackluster market returns.

Ordinary investors can use

Traditionally, investing in the fine arts was reserved for the very wealthy. Not only do you have to pay the full price of the artwork up front, but you must also be able to afford ongoing storage and insurance costs. There are no exchange-traded funds (ETFs) or art mutual funds available.

With Masterworks, small investors can buy shares of their favorite works directly. Moreover, it is open to any type of investor. You don’t have to be an accredited investor or a wealthy person to use their services.

Reliable customer support

Masterworks provides customer service by phone and email. During your first interview, you can easily get in touch with one of the platform’s art experts. This gives you the opportunity to talk about your goals and risk tolerance, after which an expert will help you choose the right art for your investment.

Skip Waitlist

Disadvantages of a masterworks io

Users should design their own art portfolio

While Masterworks charges a hefty annual management fee, you are ultimately the one who chooses the fractional stocks that make up your portfolio. Contrast this approach with Robo-advisors or mutual funds, where professional and experienced fund managers select the investment assets that make up your portfolio.

For investors with a strong interest in contemporary art, this may not be a major disadvantage. However, if you are unaware of current fine art market trends, you may be at a disadvantage when it comes to making the best choice.

That said, experts at Masterworks check the quality of each piece and list only those they think have good investment potential. But ultimately, you have to decide which jobs are best for you.

Art investment is very risky

Masterworks itself warns that investing in art comes with a lot of risks. Artwork does not generate any ongoing cash flow, such as interest payments or dividends. The only way to get a good return on investment is if someone ends up buying the part a few years later at a higher price, Masterworks doesn’t guarantee this.

The platform’s secondary market provides users with a way to cash out early, but it also comes with risks. While you can try to sell your stock, there must be another Masterworks user who wants to buy, which is also not guaranteed.

Higher art tax

Art is taxed as collectibles and the long-term capital gains tax rate is 28%. That’s higher than the long-term capital gains tax on traditional investment assets, which tops 20% for the wealthiest Americans.

Phone interview required

Before joining Masterworks, you must conduct a phone interview with one of the company’s experts. An interview is not a means of rejecting certain applications; rather, it allows Masterworks to get to know you better, answer your questions, and recommend investments.

For some potential users who prefer an online-only investing experience and want to get started right away, the interview process can be tedious.

No mobile app

Masterworks is a pure web platform. They don’t currently offer a mobile app.

The secondary market is only available to US citizens

To buy and sell stocks on the Masterworks secondary market, you must be a U.S. citizen with a U.S. bank account. This could prevent international investors from accessing a key feature of the platform.

About the Masterworks io

Masterworks is a private New York-based startup founded by Scott Lynn in 2017. The company’s first acquisition was Andy Warhol’s 1979 painting 1 Colored Marilyn (Reversal Series) for $1.82 million. In October 2021, Masterworks raised $110 million in a Series A funding round at a total valuation of just over $1 billion.